Why European equities deserve a fresh look

Summary

Share

Marketing communication

Key takeaways

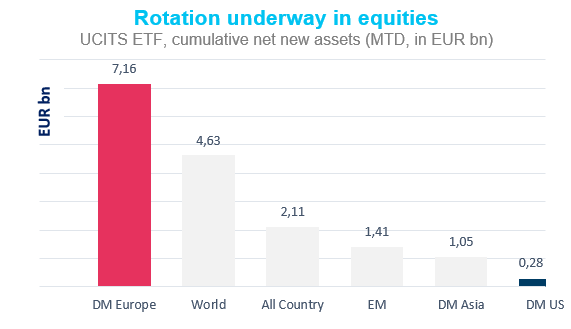

- European equities are back in vogue, supported by strong inflows and resilient market performance.1

- A more favourable macroeconomic outlook, easing inflation, and the prospect of further ECB rate cuts provide support for further upside potential.

- Financials—particularly Economic and Monetary Union (EMU) banks—stand out due to attractive valuations, stable earnings, and strong shareholder returns.1 Additionally, the Aerospace and Defence sector is benefitting from increased spending across Europe.

European equities are back in favour and, in our view, present compelling opportunities despite ongoing economic and geopolitical uncertainties. A strong start to the year,1 attractive valuations, and a more favourable macroeconomic backdrop — marked by easing inflation, a dovish European Central Bank (ECB), and the prospect of further rate cuts—have boosted investor confidence and driven demand for European equity UCITS ETFs.

Among key sectors, Financials stand out, benefiting from improving margins, stable earnings, and shareholder-friendly policies. Aerospace and defence also present opportunities, underpinned by structurally higher spending.

Source: Amundi, Bloomberg. Data as at 19/02/2025.

Past performance is not a reliable indicator of future performance.

Why we see upside potential in European equities

Global economic growth is expected to remain modest over the next couple of years, with European growth likely to lag. However, the ECB is increasingly confident of reaching its 2% inflation target this year, allowing for further rate cuts—potentially bringing rates down to 1.75% by year-end.

Lower interest rates and subsiding inflation should translate into higher real incomes, improved credit conditions, and stronger consumer demand, all of which could further support equities in the region.

Tariff risks: A manageable challenge

Uncertainty around the imposition of tariffs and their effects on European companies remains a concern. For instance, European stocks fell from record highs in late February 2025 following President Donald Trump’s threat of a 25% tariff on European Union imports, specifically targeting the automotive sector.

That said, the EU is actively working to mitigate these risks by expanding its network of bilateral and regional trade agreements to reduce reliance on the US. Importantly, from an equity perspective, we estimate that only about 6% of European corporate sales2 are at risk from tariffs, meaning that the overall market should remain resilient.

Additionally, regulatory easing could further support corporate margins, helping European companies navigate these external pressures and maintain profitability.

Attractive valuations provide room for growth

Current valuations in European equities remain attractive, reflecting a highly cautious economic outlook. However, as economic sentiment stabilises, there is significant potential for valuation multiples to expand.

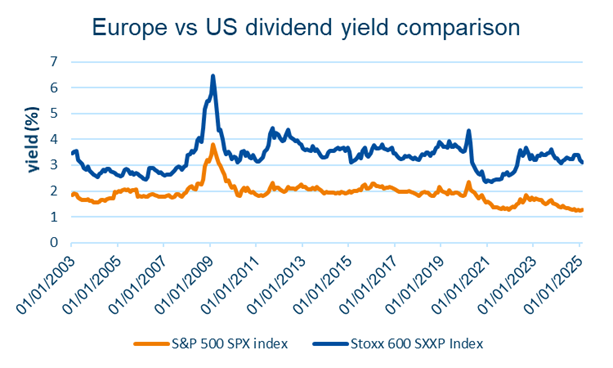

Higher dividend yields: A potential source of income

One of the key advantages of European equities is their generally higher dividend payout ratios compared to US stocks3. For instance, as shown below, the Stoxx Europe 600 offers an estimated dividend yield of 3.1%, significantly higher than the 1.3% yield of the S&P 5004. This makes European stocks particularly appealing for income-seeking investors.

Source: Amundi, Bloomberg as at 28/02/2025

Financials: A sector poised for further gains

Among the sectors driving European equity performance, Financials—particularly EMU banks—stand out as a key source of strength.

Several structural factors continue to support the banking sector:

- Reasonable valuations: Despite strong performance, European bank stocks remain fairly valued, with price-to-book ratios only slightly above historical levels.1

- Strong lending margins: Robust net interest margins, driven by higher rate levels, have supported stable earnings.

- Increased M&A activity: Banks have benefited from sector consolidation, which has improved cost efficiency, capital strength, and liquidity.

- Shareholder-friendly policies: EMU banks lead the market in shareholder returns, accounting for nearly 20% of total share buybacks in the Stoxx Europe 600 in 2024.5

These factors contributed to EMU banks delivering nearly a third of total European equity market gains last year, making them a top-performing sector again in 2025.1

The role of M&A and shareholder value creation

The European banking sector has seen increased cross-border mergers and strategic partnerships, strengthening competitiveness and enhancing profitability. Additionally, banks have effectively deployed capital through share buybacks, boosting earnings per share (EPS) and increasing investor returns.

With stable net interest margins, strategic M&A activity, and a strong focus on capital return, EMU banks remain a key sector to watch in the current market environment.

Structurally higher spending to support Aerospace and Defence

Beyond financials, another sector presenting significant opportunities is Aerospace and Defence. Defence budgets across Europe have been structurally increasing, driven by heightened geopolitical tensions and commitments to NATO spending targets. In February 2025, European Commission President Ursula von der Leyen stated that EU member states’ collective defence spending should increase “from just below 2% [of EU GDP] to above 3%,” highlighting the growing focus on security and military capabilities.

Conclusion: A market segment with strong potential

European equities have started the year on a strong footing,1 attracting renewed investor inflows and benefiting from a more favourable macroeconomic environment. While risks remain — ranging from geopolitical tensions to economic uncertainty — low valuations, falling inflation, and a supportive ECB policy stance provide a favourable setup for further upside.

The Financials sector, particularly EMU banks, remains a key driver of this momentum, benefiting from attractive valuations, strong earnings, and a shareholder-friendly approach1. Meanwhile, Aerospace and Defence stand out as a structural growth opportunity, supported by rising defence spending across Europe. This creates a compelling investment case for long-term growth.

For investors seeking diversification6, income, and long-term growth potential, European equities deserve renewed attention in today’s market environment.

Access the opportunity

1. Past performance is not a reliable indicator of future performance

2. Source: Amundi Institute - February 2025

3. Past market behaviors are not a reliable indicator of their future behaviors.

4. Source: Amundi, Bloomberg as at 28/02/2025

5. Source: Amundi ETF / Bloomberg - March 2025

6. Diversification does not guarantee a profit or protect against a loss.

KNOWING YOUR RISK

It is important for potential investors to evaluate the risks described below and in the fund’s Key Information Document (“KID”) and prospectus available on our website www.amundietf.com.

CAPITAL AT RISK - ETFs are tracking instruments. Their risk profile is similar to a direct investment in the underlying index. Investors’ capital is fully at risk and investors may not get back the amount originally invested.

UNDERLYING RISK - The underlying index of an ETF may be complex and volatile. For example, ETFs exposed to Emerging Markets carry a greater risk of potential loss than investment in Developed Markets as they are exposed to a wide range of unpredictable Emerging Market risks.

REPLICATION RISK - The fund’s objectives might not be reached due to unexpected events on the underlying markets which will impact the index calculation and the efficient fund replication.

COUNTERPARTY RISK - Investors are exposed to risks resulting from the use of an OTC swap (over-the-counter) or securities lending with the respective counterparty(-ies). Counterparty(-ies) are credit institution(s) whose name(s) can be found on the fund’s website amundietf.com. In line with the UCITS guidelines, the exposure to the counterparty cannot exceed 10% of the total assets of the fund.

CURRENCY RISK – An ETF may be exposed to currency risk if the ETF is denominated in a currency different to that of the underlying index securities it is tracking. This means that exchange rate fluctuations could have a negative or positive effect on returns.

LIQUIDITY RISK – There is a risk associated with the markets to which the ETF is exposed. The price and the value of investments are linked to the liquidity risk of the underlying index components. Investments can go up or down. In addition, on the secondary market liquidity is provided by registered market makers on the respective stock exchange where the ETF is listed. On exchange, liquidity may be limited as a result of a suspension in the underlying market represented by the underlying index tracked by the ETF; a failure in the systems of one of the relevant stock exchanges, or other market-maker systems; or an abnormal trading situation or event.

VOLATILITY RISK – The ETF is exposed to changes in the volatility patterns of the underlying index relevant markets. The ETF value can change rapidly and unpredictably, and potentially move in a large magnitude, up or down.

CONCENTRATION RISK – Thematic ETFs select stocks or bonds for their portfolio from the original benchmark index. Where selection rules are extensive, it can lead to a more concentrated portfolio where risk is spread over fewer stocks than the original benchmark.

IMPORTANT INFORMATION

This material is solely for the attention of professional and eligible counterparties, as defined in Directive MIF 2014/65/UE of the European Parliament (where relevant, as implemented into UK law) acting solely and exclusively on their own account. It is not directed at retail clients. In Switzerland, it is solely for the attention of qualified investors within the meaning of Article 10 paragraph 3 a), b), c) and d) of the Federal Act on Collective Investment Scheme of June 23, 2006.

This information is not for distribution and does not constitute an offer to sell or the solicitation of any offer to buy any securities or services in the United States or in any of its territories or possessions subject to its jurisdiction to or for the benefit of any U.S. Person (as defined in the prospectus of the Funds or in the legal mentions section on www.amundi.com and www.amundietf.com. The Funds have not been registered in the United States under the Investment Company Act of 1940 and units/shares of the Funds are not registered in the United States under the Securities Act of 1933.

This document is of a commercial nature. The funds described in this document (the “Funds”) may not be available to all investors and may not be registered for public distribution with the relevant authorities in all countries. It is each investor’s responsibility to ascertain that they are authorised to subscribe, or invest into this product. Prior to investing in the product, investors should seek independent financial, tax, accounting and legal advice.

This is a promotional and non-contractual information which should not be regarded as an investment advice or an investment recommendation, a solicitation of an investment, an offer or a purchase, from Amundi Asset Management (“Amundi”) nor any of its subsidiaries.

The Funds are Amundi UCITS ETFsand Amundi ETF designates the ETF business of Amundi.

Amundi UCITS ETFs are passively-managed index-tracking funds. The Funds are French, Luxembourg or Irish open ended mutual investment funds respectively approved by the French Autorité des Marchés Financiers, the Luxembourg Commission de Surveillance du Secteur Financier or the Central Bank of Ireland, and authorised for marketing of their units or shares in various European countries (the Marketing Countries) pursuant to the article 93 of the 2009/65/EC Directive.

The Funds can be French Fonds Communs de Placement (FCPs) and also be sub-funds of the following umbrella structures:

For Amundi ETF:

- Amundi Index Solutions, Luxembourg SICAV, RCS B206810, located 5, allée Scheffer, L-2520, managed by Amundi Luxembourg S.A.

- Amundi ETF ICAV: open-ended umbrella Irish collective asset-management vehicle established under the laws of Ireland and authorized for public distribution by the Central Bank of Ireland. The management company of the Fund is Amundi Ireland Limited, 1 George’s Quay Plaza, George’s Quay, Dublin 2, D02 V002, Ireland. Amundi Ireland Limited is authorised and regulated by the Central Bank of Ireland

- Multi Units France, French SICAV, RCS 441 298 163, located 91-93, boulevard Pasteur, 75015 Paris, France and Lyxor Index Fund, Luxembourg SICAV, RCS B117500, located 9, rue de Bitbourg, L-1273 Luxembourg, and both managed by Amundi Asset Management located 91-93, boulevard Pasteur, 75015 Paris

- Multi Units Luxembourg, RCS B115129, Luxembourg SICAV located 9, rue de Bitbourg, L-1273 Luxembourg, managed by Amundi Luxembourg S.A. located 5, allée Scheffer, L-2520 Luxembourg

Before any subscriptions, the potential investor must read the offering documents (KID and prospectus) of the Funds. The prospectus in French for French UCITS ETFs, and in English for Luxembourg UCITS ETFs and Irish UCITS ETFs, and the KID in the local languages of the Marketing Countries are available free of charge on www.amundi.com, www.amundi.ie or www.amundietf.com. They are also available from the headquarters of Amundi Luxembourg S.A. (as the management company of Amundi Index Solutions and Multi Units Luxembourg), or the headquarters of Amundi Asset Management (as the management company of Amundi ETF French FCPs, Multi Units France and Lyxor Index Fund), or at the headquarters of Amundi Ireland Limited (as the management company of Amundi ETF ICAV). For more information related to the stocks exchanges where the ETF is listed please refer to the fund’s webpage on amundietf.com.

Investment in a fund carries a substantial degree of risk (i.e. risks are detailed in the KIID and prospectus). Past Performance does not predict future returns. Investment return and the principal value of an investment in funds or other investment product may go up or down and may result in the loss of the amount originally invested. All investors should seek professional advice prior to any investment decision, in order to determine the risks associated with the investment and its suitability.

It is the investor’s responsibility to make sure his/her investment is in compliance with the applicable laws she/he depends on, and to check if this investment is matching his/her investment objective with his/her patrimonial situation (including tax aspects).

Please note that the management companies of the Funds may de-notify arrangements made for marketing as regards units/shares of the Fund in a Member State of the EU or the UK in respect of which it has made a notification.

A summary of information about investors’ rights and collective redress mechanisms can be found in English on the regulatory page at https://about.amundi.com/Metanav-Footer/Footer/Quick-Links/Legal-documentation with respect to Amundi ETFs.

This document was not reviewed, stamped or approved by any financial authority.

This document is not intended for and no reliance can be placed on this document by persons falling outside of these categories in the below mentioned jurisdictions. In jurisdictions other than those specified below, this document is for the sole use of the professional clients and intermediaries to whom it is addressed. It is not to be distributed to the public or to other third parties and the use of the information provided by anyone other than the addressee is not authorised.

This material is based on sources that Amundi and/or any of her subsidiaries consider to be reliable at the time of publication. Data, opinions and analysis may be changed without notice. Amundi and/or any of her subsidiaries accept no liability whatsoever, whether direct or indirect, that may arise from the use of information contained in this material. Amundi and/or any of her subsidiaries can in no way be held responsible for any decision or investment made on the basis of information contained in this material.

Updated composition of the product’s investment portfolio is available on www.amundietf.com. Units of a specific UCITS ETF managed by an asset manager and purchased on the secondary market cannot usually be sold directly back to the asset manager itself. Investors must buy and sell units on a secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incur fees for doing so. In addition, investors may pay more than the current net asset value when buying units and may receive less than the current net asset value when selling them.

Indices and the related trademarks used in this document are the intellectual property of index sponsors and/or its licensors. The indices are used under license from index sponsors. The Funds based on the indices are in no way sponsored, endorsed, sold or promoted by index sponsors and/or its licensors and neither index sponsors nor its licensors shall have any liability with respect thereto. The indices referred to herein (the “Index” or the “Indices”) are neither sponsored, approved or sold by Amundi nor any of its subsidiaries. Neither Amundi nor any of its subsidiaries shall assume any responsibility in this respect.

AMUNDI PHYSICAL GOLD ETC (the “ETC”) is a series of debt securities governed by Irish Law and issued by Amundi Physical Metals plc, a dedicated Irish vehicle (the “Issuer”). The Base Prospectus, and supplement to the Base Prospectus, of the ETC has been approved by the Central Bank of Ireland (the “Central Bank”), as competent authority under the Prospectus Directive. Pursuant to the Directive Prospective Regulation, the ETC is described in a Key Information Document (KID), final terms and Base Prospectus (hereafter the Legal Documentation). The ETC KID must be made available to potential subscribers prior to subscription. The Legal Documentation can be obtained from Amundi on request. The distribution of this document and the offering or sale of the ETC Securities in certain jurisdictions may be restricted by law. For a description of certain restrictions on the distribution of this document, please refer to the Base Prospectus. The investors are exposed to the creditworthiness of the Issuer.

In EEA Member States, the content of this document is approved by Amundi for use with Professional Clients (as defined in EU Directive 2004/39/EC) only and shall not be distributed to the public.

Information reputed exact as of the date mentioned above.

Reproduction prohibited without the written consent of Amundi.

UNITED KINGDOM

Marketing Communication.For Professional Clients only. In the United Kingdom (the “UK”), this marketing communication is being issued by Amundi (UK) Limited (“Amundi UK”), 77 Coleman Street, London EC2R 5BJ, UK. Amundi UK is authorised and regulated by the Financial Conduct Authority (“FCA”) and entered on the FCA’s Financial Services Register under number 114503. This may be checked at https://register.fca.org.uk/ and further information of its authorisation is available on request. This marketing communication is approved by Amundi UK for use with Professional Clients (as defined in the FCA’s Handbook of Rules and Guidance (the “FCA Handbook”) and shall not be distributed to the public. Past performance is not a guarantee or indication of future results.

Each fund and its relevant sub-fund(s) under its respective fund range that is referred to in this marketing communication (each, a “Fund”) is a recognised collective investment scheme under the FCA’s Temporary Marketing Permission Regime , except for the Amundi ETF ICAV and its sub-funds, which are unregulated collective investment schemes under the Financial Services and Markets Act 2000 (the “FSMA”, each, an “Unregulated CIS”).

For an Unregulated CIS, this marketing communication is addressed only to those persons who qualify as non-retail clients (Professional Clients or Eligible Counterparties) as set out in the FCA’s Handbook Conduct of Business Sourcebook 4.12B – “Promotion of non-mass market investments, as amended from time to time, and thereby fall with an exemption from the restrictions in Section 238 FSMA. This communication must not be distributed to the public and must not be relied on or acted upon by any other persons for any purposes whatsoever.

Potential investors in the UK should be aware that none of the protections afforded by the UK regulatory system will apply to an investment in a Fund and that compensation will not be available under the UK Financial Services Compensation Scheme.