Global equities – a staple ingredient in your portfolio

Share

Empirical evidence shows that equities have been a consistent source of long-term returns, outperforming other asset classes over multiple decades1. In addition, that longer equity holding periods may help reduce risk and improve performance.1 Yet despite this, the average equity holding period has decreased significantly over time.2

Today’s challenging economic conditions, where stretched valuations leave investors vulnerable, with little to no room for error, have reinforced our commitment to global equities as a core component of an investment portfolio.

An allocation to global equities provides geographic and sectoral diversification opportunities3 along with the ability to earn higher returns in the long-run, therefore potentially allowing investors to benefit from the equity risk premium4.

The case for long-term investing

Over the past several decades, the average holding period for equities has declined markedly, from seven years to 10 months.2 This owes largely to technological advancements, such as the automation of exchanges, which has brought down transaction costs and increased the volume of trades that can be processed, leading to the growth of high frequency trading (HFT) from the early 2000s. HFT, which uses algorithms to trade stocks at ultra-fast speed, now accounts for around 50% of total stock trading volume in the US and 40% in Europe5, and has thereby played a significant role in reducing the average stock holding period.

Technological progress has also changed the way individuals think about investing. With trading more accessible via online platforms and at one’s fingertips through mobile apps, investors have become far more active and less patient.

A potential pitfall of focussing on short-term returns, rather than long-term fundamental value, though, is that investors may be tempted to sell prematurely or buy impulsively, and this can be detrimental to long-term performance.

Equities offer the potential for consistent, long-term returns

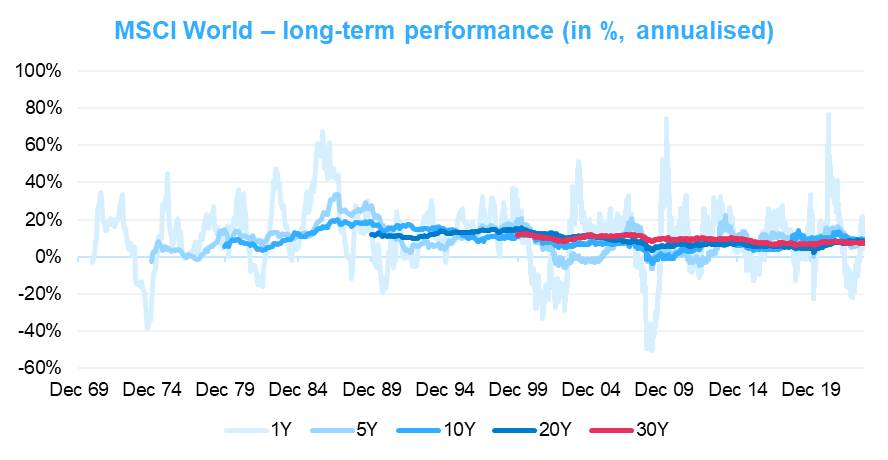

Equities can be volatile, especially over shorter periods, and it is not difficult to demonstrate why maintaining a longer investment horizon may be more desirable.

The following chart shows the range of annualised change for the MSCI World Index since the early 1970s for different holding periods (the returns are annualised to make the results comparable across different time frames). It is evident that the variability of returns diminishes as the time frame grows. This implies that expanding the time horizon of an investment into equities potentially allows for smoother compounded annualised returns compared to shorter-term returns that can face higher spikes in volatility.

Performance NTR in USD. Source: Bloomberg, Amundi. Data as at 20/02/2024. Past performance is not a reliable indicator of future performance

Evidence also suggests a longer holding period for equites improves the chances of positive performance. This of course includes times such as at the present, when valuations are stretched.

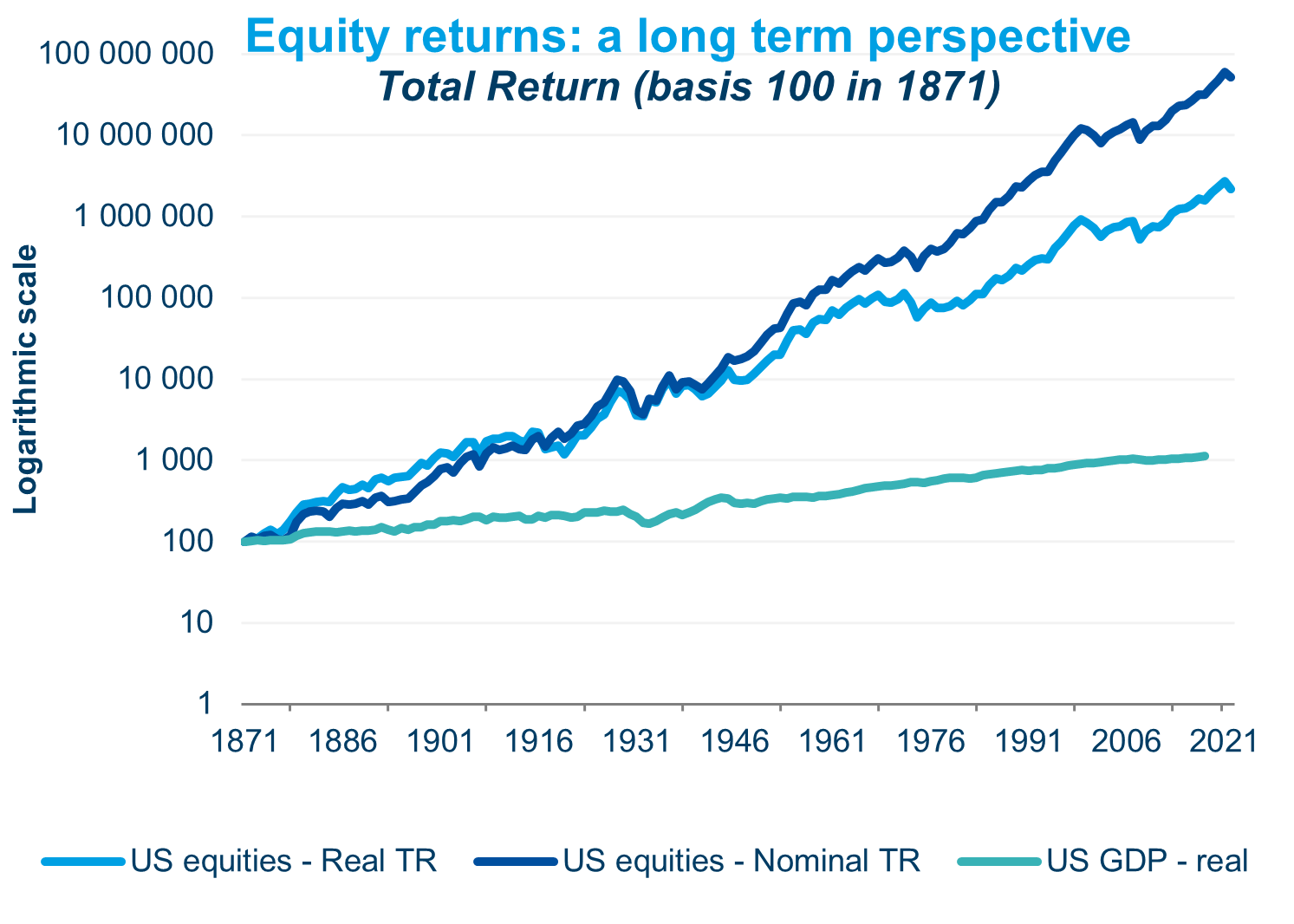

The chart that follows uses US equities as a proxy for global equities’ performance (US equities currently account for around 60% of global equities).6

Such analysis suggests around 9% of annualised returns for equities since 1871 in nominal terms (or 6.9% annualised in real terms). This compares to just 2.5% of annualised returns for government bonds on average – in real terms – over the same time span.

Source: Amundi, Shiller, Maddison Project. Data as at 22/02/2024. Past performance is not a reliable indicator of future performance.

Diversify3 and capture growth opportunities with global equities

Many investors lean towards a home-country bias in equity investing due to their familiarity with the local markets and a perception that investing domestically helps mitigate currency risk.

However, this approach may inadvertently heighten portfolio risk by limiting diversification3 to the local market, and it could also mean missing out on international return-enhancing opportunities.

By contrast, embracing global equities can offer several distinct advantages:

- Enhanced diversification3

Investing across various economies and markets can help reduce the impact of volatility in any single domestic market, potentially leading to a more stable and resilient portfolio.7

- A deeper opportunity set

An allocation to global equities can provide access to some of the world’s leading companies and a broader array of industries and sectors not always available or prominent in one's home market.

- Opportunities in different economic cycles

Investing in global equities allows you to take advantage of the varying economic cycles of different countries, capitalising on growth in expanding economies while others are contracting. This can help diversify3 potential risks as well as enhance returns.

- Attractive valuations

Global equity markets provide opportunities to buy stocks at lower valuations due to different market dynamics, providing potentially higher returns as these valuations normalize.

- Potential currency gains

Through exposure to different currencies, allocating to global equities can also help hedge against the impact of domestic currency fluctuations. A weaker home currency may boost returns on foreign investments.

Accessing the global opportunity

One of the easiest and most cost-efficient ways to invest in international equities is through ETFs, which provide investors with access to global markets through a single transaction, and trade like a stock.

Diversify3 in Developed Markets

The AMUNDI MSCI WORLD UCITS ETF, for instance, provides exposure to over 1,600 large and mid-cap stocks across 23 developed markets8. And for those looking to position their portfolios for the climate transition, there is the AMUNDI MSCI WORLD ESG CLIMATE NET ZERO AMBITION CTB UCITS ETF, which is also based on MSCI World, but selects and weights securities according to ESG criteria and EU directives on climate protection.

Capture Emerging Markets’ Growth Potential

Investors seeking an even more comprehensive level of diversification may wish to consider the AMUNDI PRIME ALL COUNTRY WORLD UCITS ETF, which offers highly-diversified3 exposure to large and mid-cap stocks in both developed and emerging markets.

The IMF estimates an average of 4.0% year-on-year (YoY) GDP growth for emerging market economies over the next five years.9 That is twice as much as the forecast for developed markets over the same period (1.7% YoY).9

The choice ultimately comes down to investor preferences and requirements.

1. https://www.investopedia.com/ask/answers/032415/which-investments-have-highest-historical-returns.asp.

Past performance is not a reliable indicator of future performance.

2. Source: NYSE, Bloomberg, Amundi. Data as of 20/02/2024.

3. Diversification does not guarantee a profit or protect against a loss.

4. The equity risk premium (ERP) refers to the additional return that investors expect to derive from investing in equities over and above that of a so-called risk-free investment such as government bonds.

5. Source: European Central Bank. Research Bulletin. No.78. How does competition among high-frequency traders affect market liquidity? December 2020

6. https://www.statista.com/statistics/710680/global-stock-markets-by-country/

7. Investment involves risks. For more information, please refer to the Risk section below.

8. For more information, please refer to the KID or the prospectus of the Fund.

9. https://www.imf.org/en/Publications/WEO

Information on Amundi’s responsible investing can be found on amundietf.com and amundi.com. The investment decision must take into account all the characteristics and objectives of the Fund, as described in the relevant Prospectus.

KNOWING YOUR RISK

It is important for potential investors to evaluate the risks described below and in the fund’s Key Information Document (‘KID’) or Key Investor Information Document (“KIID”) for UK investors and prospectus available on our websites www.amundietf.com.

CAPITAL AT RISK - ETFs are tracking instruments. Their risk profile is similar to a direct investment in the underlying index. Investors’ capital is fully at risk and investors may not get back the amount originally invested.

UNDERLYING RISK - The underlying index of an ETF may be complex and volatile. For example, ETFs exposed to Emerging Markets carry a greater risk of potential loss than investment in Developed Markets as they are exposed to a wide range of unpredictable Emerging Market risks.

REPLICATION RISK - The fund’s objectives might not be reached due to unexpected events on the underlying markets which will impact the index calculation and the efficient fund replication.

COUNTERPARTY RISK - Investors are exposed to risks resulting from the use of an OTC swap (over-the-counter) or securities lending with the respective counterparty(-ies). Counterparty(-ies) are credit institution(s) whose name(s) can be found on the fund’s website amundietf.com or lyxoretf.com. In line with the UCITS guidelines, the exposure to the counterparty cannot exceed 10% of the total assets of the fund.

CURRENCY RISK – An ETF may be exposed to currency risk if the ETF is denominated in a currency different to that of the underlying index securities it is tracking. This means that exchange rate fluctuations could have a negative or positive effect on returns.

LIQUIDITY RISK – There is a risk associated with the markets to which the ETF is exposed. The price and the value of investments are linked to the liquidity risk of the underlying index components. Investments can go up or down. In addition, on the secondary market liquidity is provided by registered market makers on the respective stock exchange where the ETF is listed. On exchange, liquidity may be limited as a result of a suspension in the underlying market represented by the underlying index tracked by the ETF; a failure in the systems of one of the relevant stock exchanges, or other market-maker systems; or an abnormal trading situation or event.

VOLATILITY RISK – The ETF is exposed to changes in the volatility patterns of the underlying index relevant markets. The ETF value can change rapidly and unpredictably, and potentially move in a large magnitude, up or down.

CONCENTRATION RISK – Thematic ETFs select stocks or bonds for their portfolio from the original benchmark index. Where selection rules are extensive, it can lead to a more concentrated portfolio where risk is spread over fewer stocks than the original benchmark.

Important information

This material is solely for the attention of professional and eligible counterparties, as defined in Directive MIF 2014/65/UE of the European Parliament acting solely and exclusively on their own account. It is not directed at retail clients. In Switzerland, it is solely for the attention of qualified investors within the meaning of Article 10 paragraph 3 a), b), c) and d) of the Federal Act on Collective Investment Scheme of June 23, 2006.

This information is not for distribution and does not constitute an offer to sell or the solicitation of any offer to buy any securities or services in the United States or in any of its territories or possessions subject to its jurisdiction to or for the benefit of any U.S. Person (as defined in the prospectus of the Funds or in the legal mentions section on www.amundi.com and www.amundietf.com. The Funds have not been registered in the United States under the Investment Company Act of 1940 and units/shares of the Funds are not registered in the United States under the Securities Act of 1933.

This material reflects the views and opinions of the individual authors at this date and in no way the official position or advices of any kind of these authors or of Amundi Asset Management nor any of its subsidiaries and thus does not engage the responsibility of Amundi Asset Management nor any of its subsidiaries nor of any of its officers or employees. This research is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. It is explicitly stated that this document has not been prepared by reference to the regulatory requirements that seek to promote independent financial analysis. It does not constitute a personal recommendation or take into account the particular investment objectives, financial situations, or needs of individual clients. Neither Amundi Asset Management nor any of its subsidiaries accept liability, whether direct or indirect, that may result from using any information contained in this document or from any decision taken the basis of the information contained in this document. Clients should consider whether any advice or recommendation in this research is suitable for their particular circumstances and, if appropriate, seek professional advice, including tax advice. Our salespeople, traders, and other professionals may provide oral or written market commentary or trading strategies to our clients and principal trading desks that reflect opinions that are contrary to the opinions expressed in this research. Our asset management area, principal trading desks and investing businesses may make investment decisions that are inconsistent with the recommendations or views expressed in this research.

This document is of a commercial nature. The funds described in this document (the “Funds”) may not be available to all investors and may not be registered for public distribution with the relevant authorities in all countries. It is each investor’s responsibility to ascertain that they are authorised to subscribe, or invest into this product. Prior to investing in the product, investors should seek independent financial, tax, accounting and legal advice.

This is a promotional and non-contractual information which should not be regarded as an investment advice or an investment recommendation, a solicitation of an investment, an offer or a purchase, from Amundi Asset Management (“Amundi”) nor any of its subsidiaries.

The Funds are Amundi UCITS ETFs. The Funds can either be denominated as “Amundi ETF” or “Lyxor ETF”. Amundi ETF designates the ETF business of Amundi.

Amundi UCITS ETFs are passively-managed index-tracking funds. The Funds are French, Luxembourg or Irish open ended mutual investment funds respectively approved by the French Autorité des Marchés Financiers, the Luxembourg Commission de Surveillance du Secteur Financier or the Central Bank of Ireland, and authorised for marketing of their units or shares in various European countries (the Marketing Countries) pursuant to the article 93 of the 2009/65/EC Directive.

The Funds can be French Fonds Communs de Placement (FCPs) and also be sub-funds of the following umbrella structures:

For Amundi ETF:

- Amundi Index Solutions, Luxembourg SICAV, RCS B206810, located 5, allée Scheffer, L-2520, managed by Amundi Luxembourg S.A.

- Amundi ETF ICAV: open-ended umbrella Irish collective asset-management vehicle established under the laws of Ireland and authorized for public distribution by the Central Bank of Ireland. The management company of the Fund is Amundi Ireland Limited, 1 George’s Quay Plaza, George’s Quay, Dublin 2, D02 V002, Ireland. Amundi Ireland Limited is authorised and regulated by the Central Bank of Ireland

For Lyxor ETF:

- Multi Units France, French SICAV, RCS 441 298 163, located 91-93, boulevard Pasteur, 75015 Paris, France, managed by Amundi Asset Management

- Multi Units Luxembourg, RCS B115129 and Lyxor Index Fund, RCS B117500, both Luxembourg SICAV located 9, rue de Bitbourg, L-1273 Luxembourg, and managed by Amundi Asset Management

- Lyxor SICAV, Luxembourg SICAV, RCS B140772, located 5, Allée Scheffer, L-2520 Luxembourg, managed by Amundi Luxembourg S.A.

Before any subscriptions, the potential investor must read the offering documents (KID and prospectus) of the Funds. The prospectus in French for French UCITS ETFs, and in English for Luxembourg UCITS ETFs and Irish UCITS ETFs, and the KID in the local languages of the Marketing Countries are available free of charge on www.amundi.com, www.amundi.ie or www.amundietf.com. They are also available from the headquarters of Amundi Luxembourg S.A. (as the management company of Amundi Index Solutions and Lyxor SICAV), or the headquarters of Amundi Asset Management (as the management company of Amundi ETF French FCPs, Multi Units Luxembourg, Multi Units France and Lyxor Index Fund), or at the headquarters of Amundi Ireland Limited (as the management company of Amundi ETF ICAV). For more information related to the stocks exchanges where the ETF is listed please refer to the fund’s webpage on amundietf.com.

Investment in a fund carries a substantial degree of risk (i.e. risks are detailed in the KID and prospectus). Past Performance does not predict future returns. Investment return and the principal value of an investment in funds or other investment product may go up or down and may result in the loss of the amount originally invested. All investors should seek professional advice prior to any investment decision, in order to determine the risks associated with the investment and its suitability.

It is the investor’s responsibility to make sure his/her investment is in compliance with the applicable laws she/he depends on, and to check if this investment is matching his/her investment objective with his/her patrimonial situation (including tax aspects).

Please note that the management companies of the Funds may de-notify arrangements made for marketing as regards units/shares of the Fund in a Member State of the EU or the UK in respect of which it has made a notification.

A summary of information about investors’ rights and collective redress mechanisms can be found in English on the regulatory page at https://about.amundi.com/Metanav-Footer/Footer/Quick-Links/Legal-documentation with respect to Amundi ETFs.

This document was not reviewed, stamped or approved by any financial authority.

This document is not intended for and no reliance can be placed on this document by persons falling outside of these categories in the below mentioned jurisdictions. In jurisdictions other than those specified below, this document is for the sole use of the professional clients and intermediaries to whom it is addressed. It is not to be distributed to the public or to other third parties and the use of the information provided by anyone other than the addressee is not authorised.

This material is based on sources that Amundi and/or any of her subsidiaries consider to be reliable at the time of publication. Data, opinions and analysis may be changed without notice. Amundi and/or any of her subsidiaries accept no liability whatsoever, whether direct or indirect, that may arise from the use of information contained in this material. Amundi and/or any of her subsidiaries can in no way be held responsible for any decision or investment made on the basis of information contained in this material.

Updated composition of the product’s investment portfolio is available on www.amundietf.com. Units of a specific UCITS ETF managed by an asset manager and purchased on the secondary market cannot usually be sold directly back to the asset manager itself. Investors must buy and sell units on a secondary market with the assistance of an intermediary (e.g. a stockbroker) and may incur fees for doing so. In addition, investors may pay more than the current net asset value when buying units and may receive less than the current net asset value when selling them.

Indices and the related trademarks used in this document are the intellectual property of index sponsors and/or its licensors. The indices are used under license from index sponsors. The Funds based on the indices are in no way sponsored, endorsed, sold or promoted by index sponsors and/or its licensors and neither index sponsors nor its licensors shall have any liability with respect thereto. The indices referred to herein (the “Index” or the “Indices”) are neither sponsored, approved or sold by Amundi nor any of its subsidiaries. Neither Amundi nor any of its subsidiaries shall assume any responsibility in this respect.

In EEA Member States, the content of this document is approved by Amundi for use with Professional Clients (as defined in EU Directive 2004/39/EC) only and shall not be distributed to the public.

Information reputed exact as of the date mentioned above.

Reproduction prohibited without the written consent of Amundi.